Key Takeaways

- Cashless transactions reduce the risk of theft and robbery.

- Digital payments minimize internal fraud through transparent records.

- Contactless methods improve health and hygiene.

- Automated systems streamline financial operations and reduce errors.

- Hybrid options ensure accessibility for all customers.

- Secure digital platforms protect sensitive data.

- Employee training is essential for smooth adoption.

In today’s fast-paced business environment, ensuring the safety and well-being of employees and customers has become a top priority. Traditional cash handling can introduce risks ranging from theft and human error to the spread of germs, creating unnecessary challenges for workplaces. By adopting systems that reduce or eliminate the reliance on physical currency, organizations can foster a more secure and efficient environment. Streamlined payment methods not only decrease the potential for financial discrepancies but also allow staff to focus on core responsibilities without the distractions and risks associated with handling cash.

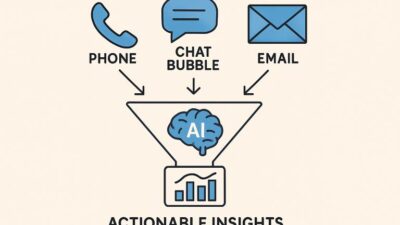

Moreover, integrating modern technology into financial transactions supports a broader culture of workplace safety. Digital tools offer enhanced tracking, reduce manual errors, and limit exposure to potential hazards. For example, digital tips can be processed seamlessly, ensuring transparency while minimizing physical contact. Overall, these innovations contribute to safer, more organized, and resilient operational practices.

Reducing Theft and Robbery Risks

Having large amounts of cash on-site elevates the risk of theft and robberies, particularly in the service, hospitality, and entertainment industries. Cash tends to attract criminals, endangering staff and customers while increasing liability. Implementing cashless systems diminishes the need to store cash, thereby reducing crime incentives and making closing processes safer by minimizing cash transport. In cities like Washington, D.C., businesses are now permitted to refuse cash payments under certain conditions, further bolstering safety. Moving toward cashless operations demonstrates a commitment to safety and the protection of all stakeholders.

Minimizing Internal Theft

Internal theft remains a persistent threat to organizational integrity and profitability. When businesses rely on cash transactions, the opportunities for altering receipts, skimming funds, or misreporting sales increase. Going cashless changes this dynamic by digitizing financial flows, so every transaction—whether a purchase, refund, or tip payout—leaves a clear digital footprint. Managers can track these records in real-time, enabling the quick identification of anomalies and simplifying traditional audit processes. This transparent environment not only helps reduce internal theft but also instills greater accountability and trust across the workforce. Teams feel more secure knowing there is a reliable record of their work, while business owners and stakeholders enjoy peace of mind and enhanced oversight of daily operations. Industry leaders note that the move towards digital transparency is reshaping how businesses of all sizes address risk and accountability.

Enhancing Health and Hygiene

Physical currency is often overlooked as a vehicle for cross-contamination, yet it is well known for harboring germs, dirt, and bacteria. In workplaces where exchanging cash is part of the daily routine, this poses ongoing health hazards, putting both staff and patrons at risk for illness. The urgency of these concerns was thrown into sharp relief during the COVID-19 pandemic, when minimizing physical touch points became essential. As a result, countless organizations accelerated their adoption of no-contact payment solutions to help protect frontline employees and consumers. Solutions like digital wallets, contactless cards, and QR code payments require little to no physical interaction, reducing harm and promoting public health. These systems not only reduce disease transmission opportunities but also help businesses demonstrate their commitment to the highest standards of cleanliness—an essential consideration for sectors such as hospitality, healthcare, and food service, where hygiene is critical.

Streamlining Financial Operations

In addition to creating a safer workplace, embracing cashless transactions helps streamline countless daily business activities. Managing cash has traditionally been a labor-intensive process, requiring regular counts, secure storage, transportation to banks, and frequent reconciliation efforts to ensure financial accuracy and integrity. Each of these steps introduces inefficiencies and potential risks. By contrast, digital payment systems automate a significant portion of these activities. Payment records are instantly logged and accessible via cloud-based platforms, enabling managers and accountants to oversee finances in real-time. Furthermore, many modern digital systems integrate seamlessly with broader business management tools such as payroll, accounting, and inventory software. This reduces administrative burdens, eliminates redundancies, and saves valuable staff time, enabling a sharper focus on core business objectives and greater adaptability in fast-changing markets.

Addressing Accessibility and Inclusivity

Despite the compelling advantages of a cashless future, businesses must remain mindful of customers who are unbanked, underbanked, or otherwise face barriers to utilizing digital payment tools. The digital divide is very real, and it is essential that companies do not inadvertently exclude vulnerable groups from participating in the economy. To ensure workplaces remain inclusive and compliant with evolving legal standards, many organizations are adopting a hybrid payment approach. This includes maintaining the option to accept cash alongside digital payments, which protects customer choice while enabling most of the operational and safety benefits associated with cashless systems. Flexible payment options also foster goodwill and reinforce the company’s commitment to serving every member of the community, regardless of their technological access or banking status.

Implementing Secure Digital Payment Systems

Transitioning to cashless payments introduces new cybersecurity challenges. With more data being transmitted electronically, organizations must ensure robust protection against risks like spoofing, identity theft, data breaches, and other cyber threats. Investing in systems that feature advanced security measures—including biometric identification, end-to-end encryption, and mutual authentication—significantly reduces vulnerabilities. These features not only safeguard sensitive information but also inspire confidence among employees and customers who may be apprehensive about digital payment risks. To maximize safety, businesses should thoroughly vet potential payment providers, conduct regular security audits, and stay updated with industry best practices. Transparent communication about security protocols and rapid response to emerging threats further fortify trust and encourage widespread adoption of new systems.

Training Employees on Digital Payment Systems

Technology alone cannot ensure a successful cashless transition. Its success hinges on employees’ ability to operate and support the new system effectively. Companies should invest in comprehensive training to help staff understand, utilize, and confidently explain the system, including troubleshooting and onboarding. Skilled employees decrease errors, enhance customer experience, and foster a safer, more efficient environment. This focus on training enhances operational resilience and boosts customer satisfaction as digital adoption increases.

Conclusion

Making the switch to cashless transactions represents more than just a compliance or convenience measure for modern businesses—it is a key strategic decision that enhances security, improves efficiency, and builds long-term resilience. By reducing criminal risks, boosting health standards, modernizing operations, and providing solutions that are both accessible and secure, organizations can better safeguard their most valuable assets: their people and reputation. By embracing these innovations and preparing thoughtfully for their integration, companies of all sizes can position themselves for success in a future where digital solutions play a central role in everyday operations, ultimately benefitting employees, customers, and communities alike.