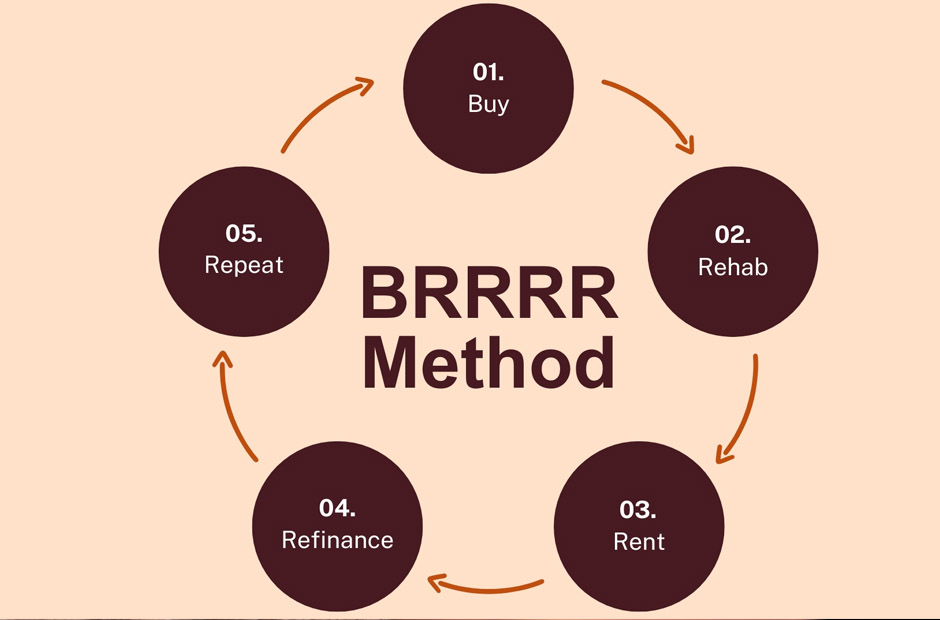

The BRRRR method—Buy, Rehab, Rent, Refinance, Repeat—is a cornerstone strategy in the modern real estate investor’s toolkit. It promises a powerful combination of forced appreciation and recycled capital, essentially allowing you to recover most of your initial investment and redeploy it. It’s a beautiful, elegant cycle on paper. But for many who jump in, the beautiful cycle quickly turns into a grueling treadmill, often because they drastically misprice the risk associated with time. They forget that every day a property sits vacant, every week a contractor is delayed, and every month a loan payment is made before the property is rented is a direct erosion of their profits and a significant increase in their risk exposure. When securing real estate investment funding from Lantzman Lending, this time-based risk must be front and center in your calculations, yet it is consistently the most underestimated variable.

The Critical Role of Hard Money and the Misunderstood Timeline

The “Buy” and “Rehab” phases of the BRRRR model are almost universally initiated with short-term, high-interest financing, most commonly a hard money real estate loan. These loans are essential because they offer the speed and flexibility required to close quickly on distressed properties that conventional lenders wouldn’t touch. They serve as the crucial bridge funding. However, the structure of these loans, often 6 to 18 months with high monthly payments and steep extension fees, is precisely what injects significant time risk into the strategy.

Many investors treat the hard money loan term as a buffer, rather than a deadline. They calculate their profits assuming an ideal timeline: a three-month rehab, a one-month stabilization period, and then a closing on the long-term refinance loan. The issue is that the real world rarely cooperates with the ideal.

A two-week delay in permit approvals, a change order for the HVAC system, or a labor shortage can easily push that four-month window into five or six. For an investor paying 1.5% to 2.5% in interest and fees per month on a six-figure loan, those extra months can consume 50% or more of their projected profit. Investors often fail to account for the interest carry—the cost of holding the loan—in their pessimistic scenario planning, focusing only on the best-case outcome.

Underestimating the ‘Rehab Creep’ and Scope Volatility

The “Rehab” phase is the most notorious source of time risk, often called “Rehab Creep.” This phenomenon is driven by two main factors: hidden damage and scope expansion.

When an investor walks through a property before buying, they’re only seeing the surface. Once walls are opened, it’s common to discover outdated plumbing, electrical wiring that isn’t up to code, or structural damage from past leaks. These are non-negotiable repairs that add both cost and, critically, time. A one-week plumbing fix can delay all subsequent work—drywall, painting, flooring—creating a domino effect.

Investors often get “scope creep.” They swap a planned quick cosmetic fix for major upgrades, like using quartz instead of laminate, hoping to boost the appraisal value during the Refinance step. While this might increase the final value, it always means delays—waiting for materials and specialized labor—turning a fast renovation into a long one. They focus too much on the potential appraisal bump and completely ignore the high cost of holding that hard money loan for all those extra months. They prioritize a slightly better “Refi” value over the critical factor of time, and that’s a big mistake.

The Refinance and Appraisal Gauntlet

Even when the rehab is complete, the risk is far from over. The “Refinance” step itself is a major time hurdle that investors frequently overlook. Refinancing from a bridge loan (such as a hard money loan) to a long-term loan (such as a 30-year conventional mortgage) is not guaranteed or instantaneous.

The process involves a new application, underwriting, and, most importantly for the BRRRR strategy, a new appraisal. The time it takes for a lender to process these applications, which can be 30 to 60 days, is often spent while the investor is still paying the higher-interest hard money loan. Delays in the appraisal—perhaps the appraiser is backlogged, or the investor has to challenge a low valuation—can drag on, further extending the holding period.

This is where the investor needs a clear exit strategy and must ensure their initial loan is structured with reasonable terms for possible extensions. Reputable sources, such as Lantzman Lending (Homepage), structure their loans with clear, predictable extension terms precisely because they understand this reality. The faster you can stabilize the rental income and secure the long-term debt, the less time-based risk you’ve absorbed.

Mitigating Time Risk Through Rigorous Planning

For a BRRRR deal to succeed, an investor needs to adopt a Time-First Mentality. This means building a robust contingency budget for both dollars and time. A simple rule of thumb is to calculate profits based on the worst-case scenario: what if the rehab takes 50% longer than planned and the refinance takes 90 days? Is the deal still viable?

If the answer is no, the deal is too risky. This includes rigorously vetting contractors for their actual track record, not just their lowest bid, and always having backup financing options lined up for the refinance before the initial closing.

Final Thoughts

The BRRRR method’s profitability is fundamentally tied to execution speed. The biggest reason investors fail to realize the promised returns is a persistent tendency to be overly optimistic about their timeline and to misprice the financing costs. They confuse a possible outcome with a probable one. Understanding that time is a tangible, dollar-for-dollar cost that accelerates with the use of high-interest bridge loans is the key to mastering this strategy. By building in a financial and time buffer for the unexpected, and by choosing appropriate real estate investment funding from Lantzman Lending, investors can shift their focus from merely surviving the BRRRR cycle to truly repeating it successfully.