Key Takeaways

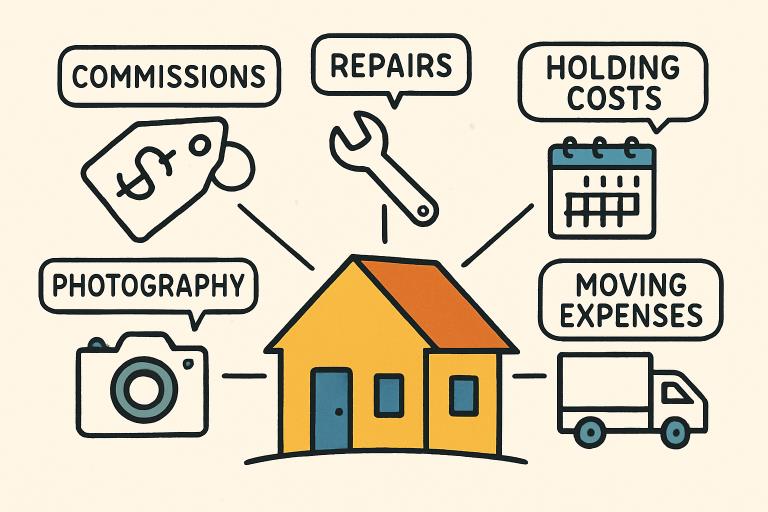

- Traditional home sales involve various hidden costs that can cut into your profits.

- Understanding these expenses upfront can help homeowners budget and make informed decisions.

- Exploring alternatives, such as direct home buying companies, may reduce costs and stress.

Selling your home the traditional way can be an emotional and complex experience. What many homeowners do not realize is that beyond the sale price and anticipated fees, there is a long list of hidden costs that can significantly reduce your net profit. If you want to ensure a smoother transaction, understanding these expenses and planning ahead is critical. For those looking to avoid the pitfalls and move quickly, consider alternatives such as direct home buyers. If you are in Fayetteville, you can find more information here https://www.mikeotranto.com/sell-your-house-fast-in-fayetteville-nc/.

Traditional sales include fees and expenses before, during, and after the sale, often overlooked until late in the process. These can catch homeowners off guard, especially first-time sellers or those who have not sold a property in a while. Understanding the breakdown of each expense category will help you maximize your outcome and make a well-informed choice about the best sales strategy for your situation.

Additionally, many sellers underestimate the time and effort required to prepare their home, negotiate terms, and handle unexpected obstacles. This can result in missed opportunities and increased expenses if not properly anticipated. Being mindful of these budget-draining factors can allow you to maintain better control over the selling process.

If you are exploring ways to sell your North Carolina property fast or want more guidance about your options, this resource can help https://www.mikeotranto.com/.

Real Estate Agent Commissions

The single largest cost for most sellers is the real estate agent’s commission. Typically, this fee ranges between 5% to 6% of the home’s final sale price. Both the buyer’s and seller’s agents usually split this amount, but as the seller, you are responsible for paying the total at closing. To put this in perspective, a $400,000 home could have up to $24,000 in commission fees. Even if agents offer flexible rates, negotiating commissions early can save thousands over the course of the sale.

Pre-Sale Repairs and Upgrades

Before you can list your property, it is common to make repairs and updates to enhance the home’s appeal and potentially attract higher offers. Common upgrades include interior painting, landscaping, cleaning, replacing fixtures, and addressing minor or major repairs, such as leaky plumbing or roof issues. These improvements may cost several thousand dollars or more, especially if the property is older or requires structural repairs. For many sellers, preparing a home for sale can cost $5,000 to $15,000, depending on the property’s age and condition.

Home Staging and Professional Photography

Today’s buyers expect homes to look their best both online and in person. Home staging is a popular technique for making spaces appear more spacious and attractive, but it comes with a price tag of $800 to $2,800, depending on the amount of work required. Professional photography, which ensures your listing stands out, typically costs between $200 and $1,000. While these expenses often provide a good return by attracting buyers quickly, they are additional out-of-pocket costs for sellers.

Holding Costs

Every month your home is on the market, you are responsible for ongoing expenses, including mortgage payments, property taxes, insurance premiums, utilities, and HOA fees. Even a relatively short listing period of 2 or 3 months can lead to several thousand dollars in ongoing costs. Longer periods may force sellers to keep up with dual mortgages, especially if they have already purchased a new property.

Closing Costs

In addition to agent commissions, sellers frequently pay for a range of closing costs. These include title insurance, escrow service fees, transfer taxes, and sometimes attorney fees. Closing costs can add another 1% to 3% to the sale price, squeezing your final payout even further. The exact charges vary from state to state, but careful planning can help set realistic expectations of your net proceeds.

Buyer Negotiations and Concessions

Once your property is under contract, inspections and appraisals introduce another set of negotiations. Buyers often request repairs, price reductions, or concessions to cover closing costs. These requests are particularly common after a home inspection reveals issues such as roofing repairs, electrical upgrades, or pest treatments. If the seller refuses, the buyer may walk away or counter with lower offers, ultimately affecting your bottom line.

Moving and Transition Expenses

The costs do not stop at the closing table. Relocation can be a significant expense, particularly if you hire a professional moving service, rent a moving truck, require temporary storage, or rent a place to live while transitioning. For most sellers, moving costs range from $1,000 to $4,000, but they can soar if long-term storage or temporary housing is needed before settling into your next home.

Unexpected Costs and Emotional Toll

Beyond the financial implications, selling the traditional way can be emotionally taxing. The process is prone to delays due to financing issues, buyer negotiations, or failed deals. Unanticipated repairs or additional holding periods often create high stress for sellers. Being mentally and financially prepared can help ease the strain while keeping your expectations realistic throughout the process.

Conclusion

Selling a home the traditional way involves more than just listing and waiting for an offer. From agent commissions and repairs to holding costs, closing fees, and moving expenses, hidden costs can significantly reduce your profits. Being aware of these potential expenses and planning accordingly helps you budget effectively and avoid surprises. For homeowners seeking a faster, simpler alternative, options like direct home buyers can minimize costs, reduce stress, and streamline the sale process.